Case Study: Using AI to reduce compliance costs for full service clients

Nick Houldsworth

Connected Accountants, a full-service accounting firm based in Wellington, has consistently led the way in integrating technology to improve service delivery and client satisfaction. Specialising in offering comprehensive financial advice and a range of services to a diverse client base, from tax and compliance, to business growth, and process and technology improvements.

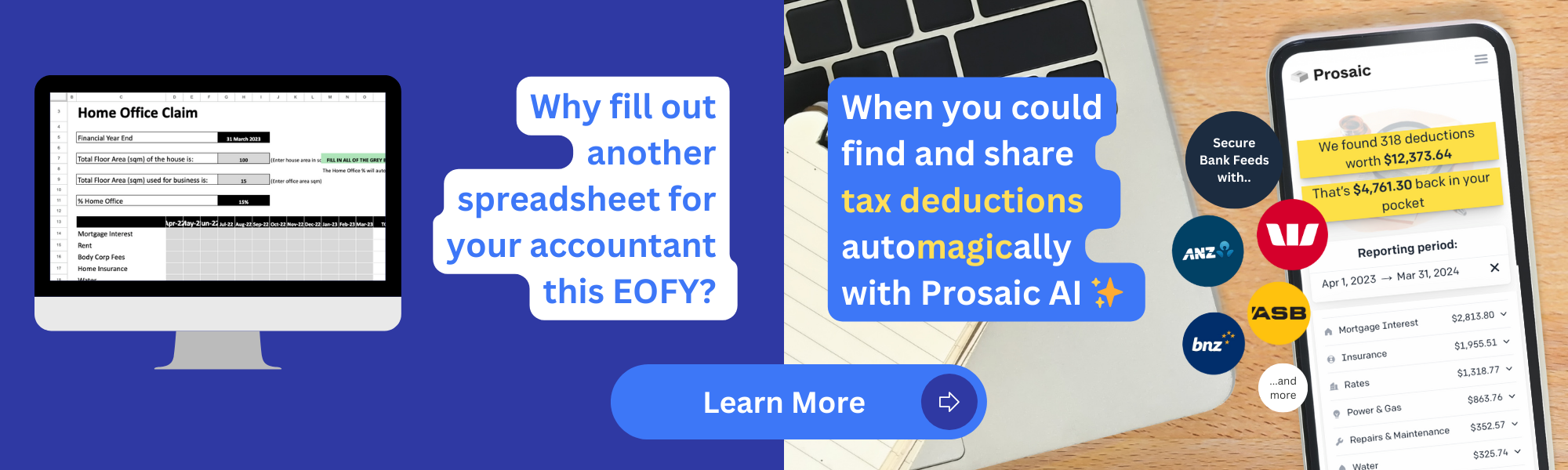

As early adopters of accounting technology, Prosaic, an AI-powered expense management tool, was a natural fit for their practice and client base.

Challenge: Efficient Compliance and Tax Optimisation For Different Client Needs

A challenge faced by full service practices like Connected Accountants is the variability in managing compliance costs under a fixed pricing model, particularly when client financial data is often spread across multiple systems and accounts. Maintaining clean books in Xero and business bank accounts has led to significant improvements in compliance efficiency, but inevitably there are times of year, common use cases like home office expense claims, or more bespoke clients, where the financial information needed to complete tax returns is not easily accessible, and requires a lot of manual back and forth. This leads to margin cost pressure, a poor client experience, and less time to focus on the value added services that differentiate Connected Accountants.

Solution: AI-powered tax deductions from a wide range of financial data

"I’m stoked knowing that my accountant - who knows more than me about what we can claim - can just take care of it for me” Jamie McLean

Connected Accountants were introduced to Prosaic by a long time client, Jamie McLean, who discovered the product, and was keen on both the time and tax saving benefits. “I know we’re missing out on potential tax deductions, but with my wife and I both running our own businesses our finances can get complicated, and the time and effort it takes to look through all our bank accounts means we just don’t do it,” says Jamie. “Prosaic instantly fetches bank transactions from all our accounts, and suggests tax deductions. But importantly, as a busy SME owner, I’m stoked knowing that my accountant - who knows more than me about what we can claim - can just take care of it for me”.

Jamie’s feedback underscores an important differentiator and benefit of the platform - Prosaic works behind the scenes to do the toil that neither accountant nor client enjoy - fetching and making sense of a wide and disparate range of financial data - so that the accountant can leverage their expertise to get the optimal tax outcome for their client, and free up the client to focus on their business instead.

The Prosaic team worked closely with Kevin Summerhays, Director at Connected Accountants, and the team to pilot the solution for a small number of clients, before planning a wider roll out. Early feedback from the practice has been instrumental in shaping the product, and ideal client profile.

"Prosaic changes the conversation from us chasing clients, to them coming to ask about how we can optimise their returns.” Kevin Summerhays

“Our clients have a wide range of needs, from business growth, to technology,” says Kevin Summerhays, “but to unlock added value, it's critical that we build upon a base of efficient, accurate and timely tax compliance. Prosaic provides real time visibility into a range of eligible tax deductions that till now, we’ve only been able to get from clients once a year, if at all, and only after a lot of back and forth by email and spreadsheet. By working behind the scenes looking for deductions instead, Prosaic changes the conversation from us chasing clients, to them coming to ask about how we can optimise their returns.”

Impact: A shift from chasing clients for information, to asking for confirmation

The feedback from Jamie and Kevin reflects a shared appreciation for the opportunity for Prosaic to not only streamline expense management, but also deepen the trust clients place in their accountants, recognising the unique professional experience ‘personal touch’ they bring to clients - a critical service differentiation in a fast changing technology landscape. This model is particularly beneficial for busy SME owners like Jamie, who prefer to leave their financial management to experts, ensuring peace of mind and time better spent elsewhere.

Importantly, for the practice, for claims like home office deductions, it allows them to accurately submit an average of around $425 deductions per month, as part of normal GST runs, which not only improves client cash flow, but removes the need to seek and recalculate actuals and GST adjustments at year end, saving admin overhead for every client.

Conclusion

The adoption of Prosaic into Connected Accountants' suite of services showcases the firm's progressive approach to new technology, and tackling the challenges of financial management and client service. As they continue to harness technology like Prosaic, it reaffirms its dedication to delivering exceptional service that meets the evolving needs of its clients,

---------

Director, Connected Accountants

Connected Accountants are a small accounting firm based in the heart of Wellington's CBD who use Xero's cloud-based connectedness to improve the financial results for the clients they choose to work with. They are business growth specialists that work with business owners that want more.

Director Sovente

Jamie McLean is a director of Sovente, a growth marketing consultancy, and Kate McLean Homecare, an in-home care agency in Auckland.