Navigating Freelance Finances: A Comprehensive NZ Guide for 2024

Prosaic Team

In 2024, navigating the financial landscape as a freelancer in New Zealand presents both opportunities and challenges. With the freedom of self-employment comes the responsibility of managing taxes, savings, and retirement plans independently. This guide aims to demystify the essentials of freelance finances, ensuring you're well-equipped to thrive.

Tax Obligations

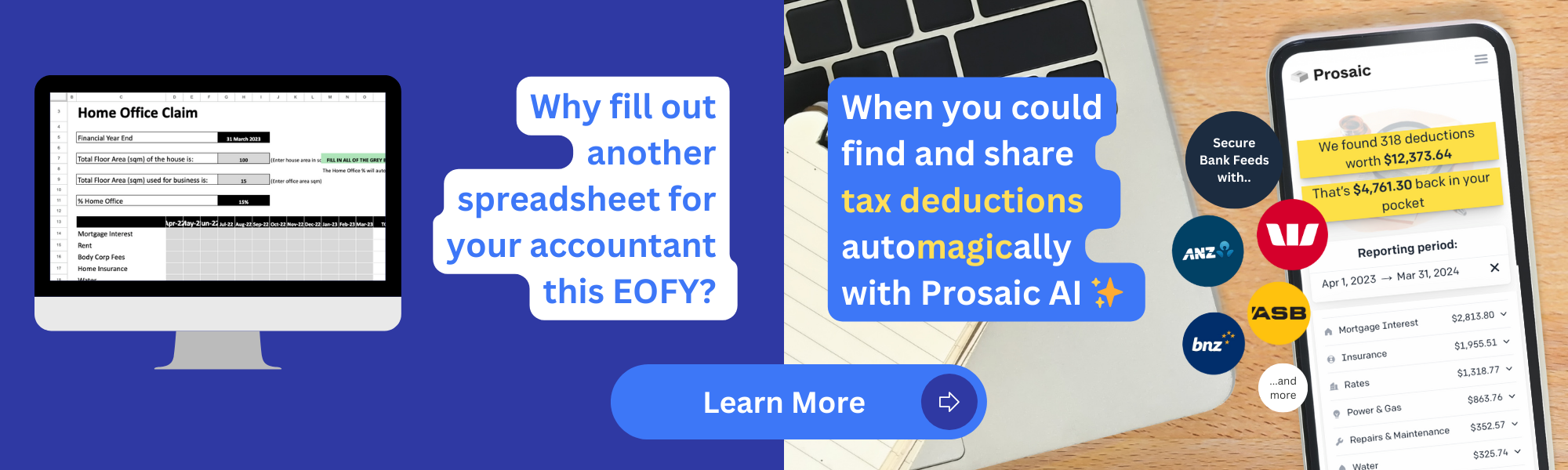

As a freelancer, you're required to file an IR3 tax return annually. Understanding your deductible expenses can significantly reduce your tax liability. Common deductions include home office costs, equipment, and business-related travel. Utilising accounting software can simplify tracking these expenses throughout the year.

KiwiSaver for Freelancers

Participation in KiwiSaver is voluntary but highly recommended for freelancers. Without an employer to contribute, you'll need to manage your contributions. A smart strategy is to set aside a fixed percentage of your income for KiwiSaver, ensuring your retirement savings grow consistently.

Emergency Fund:

The unpredictability of freelance income underscores the importance of an emergency fund. Aim to save at least three months' worth of living expenses. This fund acts as a financial buffer during lean periods, providing peace of mind and stability.

Invoicing Practices:

Prompt and professional invoicing is crucial for maintaining cash flow. Include clear payment terms on each invoice and consider offering multiple payment methods to clients. For overdue payments, a gentle reminder can often expedite the process.

Financial Planning:

Engaging with a financial advisor can offer tailored advice, particularly when it comes to investments and saving for retirement. As your freelance career evolves, regular reviews of your financial plan will ensure it remains aligned with your goals.

In summary, while managing finances as a freelancer in New Zealand requires diligence and planning, it also offers the freedom to shape your financial future. By staying informed and proactive, you can navigate the freelance financial landscape with confidence and success in 2024 and beyond.