Preparing for Financial Year End 2024 in New Zealand: A Comprehensive Guide

Prosaic Team

As the financial year end 2024 approaches in New Zealand, businesses and individuals alike are gearing up to ensure their financial affairs are in order. Preparing for year-end is crucial for effective tax planning, compliance, and financial health. Here's how you can prepare efficiently and possibly even reduce your tax liabilities.

Review Your Financial Records:

Ensure all your financial transactions are recorded accurately in your accounting software. This includes invoices, receipts, bank statements, and any other documentation that supports your income and expenses. Accurate records are not only essential for tax purposes but also provide you with a clear picture of your financial position.

Maximize Your Deductible Expenses:

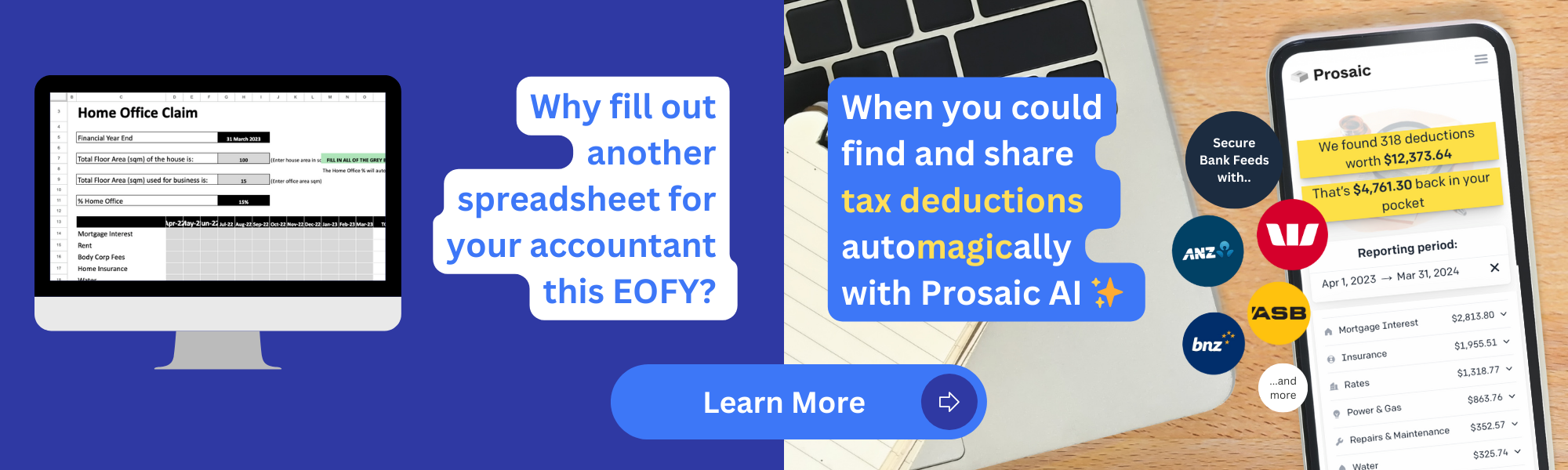

Review your expenses to identify any deductible items you haven't claimed yet. This could include business-related purchases, home office expenses, or professional development costs. Tools like Prosaic and Xero are helpful at automating this. Pre-purchasing some of next year's expenses before the year-end can also be a strategic move to reduce your taxable income.

Contribute to Your KiwiSaver:

For individuals, consider maximizing your KiwiSaver contributions to ensure you receive the full government contribution. For businesses, contributing to employee KiwiSaver accounts can also offer tax benefits.

Evaluate Your Asset Register:

Depreciating assets can reduce your taxable income. Review your asset register and write off any obsolete or unsellable stock before the year-end. This is also a good time to make any necessary asset purchases, as buying before year-end can increase your expense deductions.

Reconcile Your Accounts Receivable and Payable:

Chase up any outstanding invoices to improve your cash flow and ensure your accounts receivable are up to date. Similarly, review your accounts payable to see if there are any invoices you can pay before year-end to increase your deductible expenses.

Consult with a Tax Professional:

Tax laws in New Zealand can be complex, and consulting with a tax professional can provide you with tailored advice to optimize your tax position. They can help you with strategies you might not have considered and ensure you're compliant with all IRD requirements.

Plan for the Next Financial Year:

Finally, use this time to set financial goals for the coming year. Reviewing the past year's performance can provide valuable insights into areas for improvement and growth opportunities.

Preparing for the financial year end is an opportunity to review and reset. By taking proactive steps now, you can minimize your tax liabilities, improve your financial health, and set a strong foundation for the year ahead.